High rises are gaining ground in Dallas where the average building height is six floors (credit: RentCafe).

High rises are gaining ground in Dallas where the average building height is six floors (credit: RentCafe).

DALLAS—As cities become denser and demand for housing skyrockets, developers are increasingly abandoning urban sprawl in favor of high-rise projects. RentCafe's most recent study reveals that high rise and mid-size apartment buildings are overshadowing low-rises for the first time in 30 years.

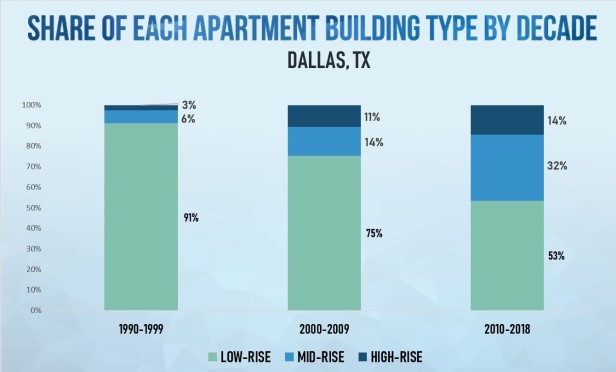

While low-rise apartment construction was the norm three decades ago, that is no longer the case. During the '90s, 91% of the new apartment buildings were low-rise. Then, the average US apartment building had three floors, the following decade, the average height was around four stories and this decade, with a boost in high-rise construction, the average building height rose to six floors.

From 2000 to 2009, new development in Dallas consisted of 11% high-rise and 14% mid-rise apartment buildings. And more recently, between 2010 and 2018, low rises lost even more ground, as 14% of new apartment complexes were high rise, while 32% were mid-rise. Now, Dallas is ranked seventh among the 30 largest US cities, based on the share of high-rise apartment buildings built there in the last decade.

"This study shows a visible increase in the share of high-rises during the past three decades and a decrease in low-rise developments," Florentina Sarac, research analyst and real estate writer with RentCafe, tells GlobeSt.com. "The share of mid-rises has also increased in Dallas compared to three decades ago, from 6% in the '90s to 32% in the '10s. In addition to delivering more high- and mid-rise apartment buildings, Dallas also saw its number of average floors for all types of buildings go up along the years, almost doubling from four in the '90s to seven in the '10s."

The study is based on the apartment construction in the 30 largest US cities across the last three decades. It was compiled by analyzing data on multifamily buildings from Yardi Matrix.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.