Four Corners Property Trust acquired another 14 outparcel properties, adding to its retail ownership.

Four Corners Property Trust acquired another 14 outparcel properties, adding to its retail ownership.

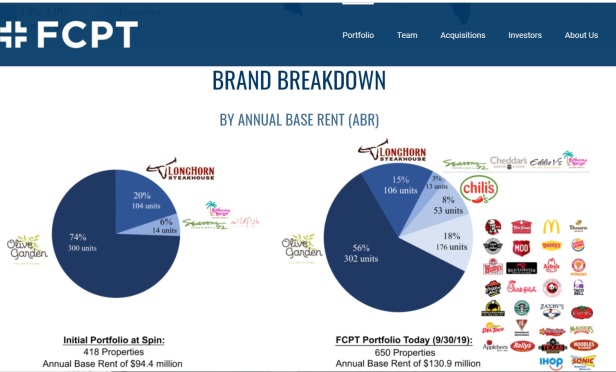

MILL VALLEY, CA—Four Corners Property Trust, a real estate investment trust engaged in the ownership of net-leased restaurant properties, has signed a definitive agreement for the purchase of 14 outparcel properties from PREIT for $29.9 million. The transaction is priced at a 6.5% going-in cash cap rate, exclusive of transaction costs. The portfolio includes 10 single tenant restaurant properties, three non-restaurant retail properties and one restaurant-anchored multi-tenant property. The properties are expected to close on a rolling basis from the fourth quarter of 2019 through the first half of 2020, subject to customary closing conditions, seller's board approval and regulatory approvals.

The 14 outparcels span 10 restaurant brands: BJ's Restaurant, Burger King, Chick-Fil-A, Chipotle, Chuck E. Cheese (two), IHOP, Olive Garden, Outback Steakhouse, Starbucks and Texas Roadhouse. The portfolio also includes five non-restaurant brands: Firestone, Mavis and REI, with Sleep Number and Verizon as part of the BJ's Restaurant-anchored multi-tenant property. All of the non-restaurant outparcels share similar qualities with FCPT's restaurant assets and are in close proximity to FCPT-owned restaurants. The properties in this transaction have building or leased-space sizes comparable to FCPT's existing portfolio, contractual rent stream growth, net-lease structures and strong tenancy with credit-worthy operators.

The retail outparcels are located within highly trafficked and populated corridors in Maryland, Michigan, North Carolina, Pennsylvania and South Carolina. Of the 16 leases, 15 are with the brand's corporate entities. Each property has a separate individual lease and the leases have a current weighted average remaining term of approximately eight years. Additionally, six of the 14 properties are either recently constructed or remodeled within the past year as part of PREIT's redevelopment strategy.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.