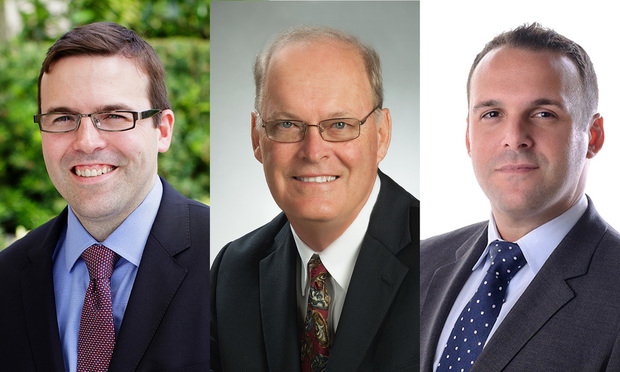

(L to R) Kenneth Naylor is chief operating officer at Atlantic I Pacific Communities, Tam English is executive director at the Housing Authority of the City of Fort Lauderdale, and Jason Kaye is vice president of Community Development Banking at Bank of America. (Photo: Courtesy Photo)

(L to R) Kenneth Naylor is chief operating officer at Atlantic I Pacific Communities, Tam English is executive director at the Housing Authority of the City of Fort Lauderdale, and Jason Kaye is vice president of Community Development Banking at Bank of America. (Photo: Courtesy Photo)

More multifamily will rise near downtown Fort Lauderdale, but it's not exactly what you would expect.

With much of the new South Florida construction focuses on high-priced apartments, Sailboat Bend II will be an affordable community for residents 55 and older.

Miami-based Atlantic I Pacific Communities LLC in partnership with the Fort Lauderdale Housing Authority obtained $36 million financing Nov. 4 for the plan.

The nine-story Sailboat Bend II will be on housing authority land south of the New River at 437 SW Fourth Ave. next to the Sailboat Bend I affordable housing community for people 62 and older.

Construction is set to wrap up this year on 100 one-bedroom units with rents from $368 to $1,313 and and 10 two-bedrooms units with rents from $440 to $1,700.

The average effective rent in Fort Lauderdale reached $1,620 late last year, according to Marcus & Millichap.

The $36.7 million breaks down to $25.35 million in tax credit equity and a $7.75 million mortgage from Bank of America. The development also comes with $2.36 million from the housing authority, $783,250 from Fort Lauderdale and $124,000 from Broward County.

Atlantic I Pacific and the housing authority were awarded $2.56 million in low-income housing tax credits from the Florida Housing Finance Corp., which sold them to Bank of America. The bank will get that amount in federal income tax credits annually over a decade and put the corresponding $25 million into the project as equity.

The developers separately secured a $26.6 million construction loan. It's needed because the tax equity isn't available until the project is finished, said Gregory Griffith, Atlantic I Pacific vice president.

"You need some source to bridge the gap since you don't have all that equity available from day one. The $25.3 million and a portion of that will come in once the project is complete and will pay the construction loan down to the permanent loan amount of $7.75 million," he said.

Atlantic I Pacific chief operating officer Kenneth Naylor said the project provides much-needed affordability.

"We are honored to work alongside our partners Bank of America Community Development Banking and the Housing Authority of the City of Fort Lauderdale on developing Sailboat Bend II. Together we have made a significant positive impact on addressing the need for affordable housing in Fort Lauderdale," Naylor said in a news release.

Jason Kaye, senior vice president of community development banking at Bank of America, echoed this.

"As we see the skyline evolve with luxury high-rises, we need to balance that growth with the increasing need for affordable housing, and that need is dire for our senior population, where most of them live solely off Social Security income," he said in a news release. "These are people who have lived in our community most if not all of their lives."

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.