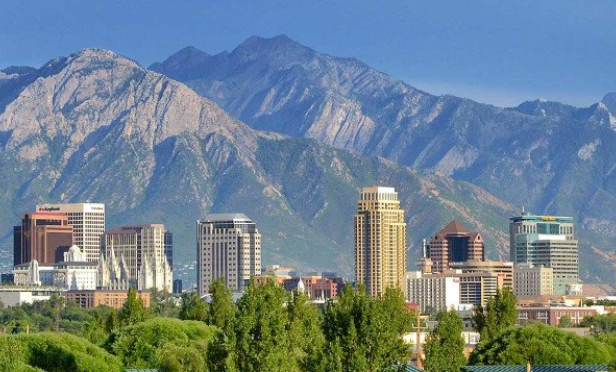

Catalyst Opportunity Funds has launched its first three investments. The projects are located in Salt Lake City and Bozeman, Montana, and represent a total investment of $28 million. The projects include Industry SLC and Pickle and Hide in Salt Lake City, which will transform outdated industrial properties into creative office and retail, and in Bozeman, Catalyst is investing in a 60-unit workforce-attainable apartment complex.

Catalyst Opportunity Funds has launched its first three investments. The projects are located in Salt Lake City and Bozeman, Montana, and represent a total investment of $28 million. The projects include Industry SLC and Pickle and Hide in Salt Lake City, which will transform outdated industrial properties into creative office and retail, and in Bozeman, Catalyst is investing in a 60-unit workforce-attainable apartment complex.

"We positioned the fund to be an impact investment fund that is focused on getting market-rate or even better than market-rate returns for investors while identifying opportunities where our investment can have an impact in the low-income communities where we are investing," Jeremy Keele, managing partner at Catalyst, tells GlobeSt.com. "The thesis is to identify markets throughout the country that have historically been under invested and finding high-impact projects that are supported by the local community."

All of the projects will work to revitalize blighted communities, ensuring the social impact component of the opportunity zone legislation is met. "The first three projects are all in the mountain west, and all three really focused on workforce affordable housing and neighborhood revitalization," says Keele. "We are taking dilapidated, rundown, industrial neighborhoods and working with sponsors that know the neighborhoods well to create product that is geared toward bringing the neighborhood back to life through investment and infrastructure."

In fact, Catalyst is already seeing success through its investments. At Pickle and Hide in Salt Lake City, the redevelopment project has catalyzed other developments and investment in the neighborhood, the Granary District. "That is really the first flag that has been planted in the neighborhood for a number of decades," says Keele. "Already that investment is triggering a second wave of investment in the infrastructure in and around that project for a three-block radius. It is an additional billion dollars of investment that has been identified. It is bringing that neighborhood back to life."

Many opportunity zone funds are eschewing the social impact segment of opportunity zones, choosing instead to focus on markets that are experiencing or already experience revitalization. Catalyst, however, has shown that it is possible to achieve both healthy returns for investors and intentional investing. "Our roots are deep in impact investing, so there really is an authentic commitment. We really wanted to establish a best-in-class high watermark for opportunity zone fund managers and to demonstrate through example what it means to be intentional to find communities and developers that have the right philosophical alignment and are thinking about the needs of the community and how investment in the built environment can address some of those needs," says Keele.

While Catalyst is focusing on Mountain West for its first projects, it is considering opportunities throughout the US. "We are underwriting deals in the Midwest right now, and then some other properties in mountain west," says Keele. "Opportunistically, we will go into other markets. Those markets fit a thesis that we have around solid fundamentals and diversified economies but where there has been underinvestment on a localized neighborhood level. We think that there are latent demand drivers that our investment and other investment could activate and transform those neighborhoods."

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.