Source: Dodge Data & Analytics

Source: Dodge Data & Analytics

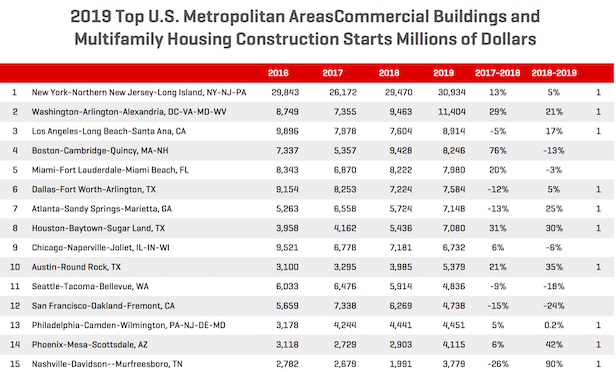

HAMILTON, NJ—The New York-New Jersey metropolitan area continues to be the largest market in the nation for commercial and multifamily starts, according to a report released by Dodge Data & Analytics.

Commercial and multifamily starts in the NY-NJ region totaled $30.9 billion in 2019. However, the New York metro region's rate of growth eased in 2019 to 5% from a 13% gain in 2018, according to the report.

Multifamily activity was the main driver behind the overall construction starts increase moving 9% higher over 2018 in the New York-New Jersey metro market. The largest multifamily building to break ground in 2019 was the $629-million Pacific Park Mixed-Use project in Brooklyn. Also getting underway in 2019 was the $600-million 601 W 29th Street building and the $500-million second phase north tower of the Hunters Point South. Commercial starts, however, were essentially flat in 2019 with gains in warehouses and parking structures offsetting declines in office, hotel, and retail buildings. The largest commercial structures to break ground in 2019 were the $1.1-billion TSX Broadway Hotel, a $400-million consolidated rental car facility at Newark International Airport and a $300 million warehouse on Staten Island.

Nationally, commercial and multifamily starts were up 1% in 2019 at $227.5 billion. The top 10 metropolitan areas gained 8% during the year, with seven of the 10 reporting year-over-year gains. In second-tier metropolitan areas (those ranked 11-20), gains in commercial and multifamily starts were stronger at 17% with eight of these 10 also posting growth.

The Washington, DC area held on to second place in 2019, posting an 18% gain to $11.4 billion. The Los Angeles metro jumped from fifth place in 2018 to third in 2019 due to an 17% increase that brought the value of commercial and multifamily starts to $8.9 billion. Other top-10 markets posting gains in 2019 were Dallas up 5% ($7.6 billion), Atlanta up 25% ($7.1 billion), Houston up 30% ($7.1 billion), and Austin up 35% ($5.4 billion). The remaining top-10 markets — those posting declines in 2019 — were Boston down 13% ($8.2 billion), Miami down 3% ($8.0 billion), and Chicago down 6% ($6.7 billion). Together, the top 10 metro areas accounted for 45% of all U.S. commercial and multifamily construction starts in 2019, up from 42% in 2018.

For the second-tier metro areas ranked 11-20, the seven posting gains were Philadelphia up less than 1% ($4.5 billion), Phoenix increasing 42% ($4.1 billion), Nashville up 90% ($3.8 billion), Orlando up 42% ($3.7 billion), Minneapolis gaining 11% ($3.5 billion), Portland OR moving 80% higher ($3.4 billion), Columbus up 57% ($2.9 billion), and Tampa up 83% ($2.8 billion). The two markets posting declines in starts were San Francisco down 24% ($4.7 billion) and Seattle down 18% ($4.8 billion). The 10 second-tier metropolitan areas accounted for 17% of U.S. commercial building and multifamily starts, up from 15% in 2018, according to the report.

Richard Branch, chief economist for Dodge Data & Analytics, says, that while strong demand for office and warehouse buildings continues to pushes the value of commercial construction to higher levels, multifamily sector construction starts are past their peak and entered cyclical decline.

"For 2020 multifamily construction starts are likely to continue lower as the declines broaden to more and more metropolitan areas.," Branch says. "Meanwhile commercial starts have posted gains for nine consecutive years, but a slowing economy in 2020 will likely lead to fewer large value projects, causing national starts to pull back from their 2019 level."

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.