TRENTON, NJ—With Gov. Phil Murphy scheduled to give his budget address later today, the New Jersey Business and Industry Association released a scathing report on Monday that puts New Jersey at the bottom of the region in terms of business climate.

In its updated 2020 Business Climate Analysis, the NJBIA report states that New Jersey has the least competitive business climate, with the highest corporate tax, state sales tax, income tax and property taxes in the region when compared to Massachusetts, Connecticut, New York, Pennsylvania, Maryland and Delaware.

"Once again, New Jersey is dead last on overall regional competitiveness and affordability," says NJBIA president and CEO Michele N. Siekerka, Esq. "The only way for New Jersey to turn this situation around is with comprehensive reforms that are long-term and sustainable, not more tax increases and short-term fixes that only get the state through the next one-year budget cycle or two-year election cycle."

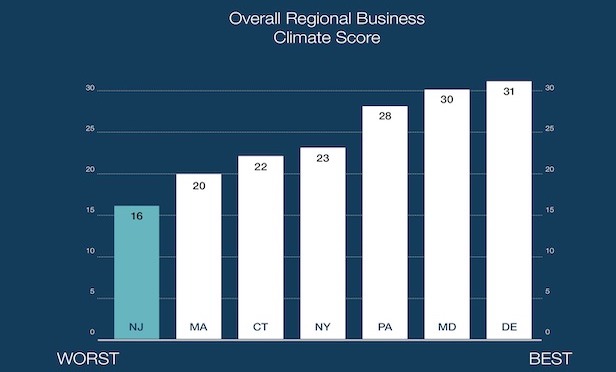

New Jersey's overall business climate score (16) was the weakest for the third straight year. Once again, Delaware (31), Maryland (30), and Pennsylvania (28) were ranked first, second and third. New York's overall score (23) improved one point from 2019 to secure fourth place, while Connecticut (22) dropped one point this year to finish fifth behind New York. Massachusetts (20) ranked sixth both years.

NJBIA's annual Regional Business Climate Analysis, which was prepared by NJBIA director of economic policy research Nicole Sandelier, points to six factors that affect business competitiveness—minimum wage, top income tax rate, top corporate tax rate, state sales tax rate, top unemployment tax rate and property taxes as a percentage of income—in gauging how New Jersey ranks against the six other states in the region.

Compared to the six other states, New Jersey had the highest top income tax rate (10.75%), top corporate tax (10.5%), state sales tax (6.625%) and property taxes paid as a percentage of income (5.05%).

Those dubious rankings are on top of New Jersey's onerous regulatory climate and challenges in supporting an innovation ecosystem seen in some other regional states, the NJBIA states.

The NJBIA also criticized a proposal released last week by State Senate President Steve Sweeney to not sunset a corporate business tax hike that was to end in 2022. The current top corporate tax rate in New Jersey is the second highest in the nation.

"Misguided proposals that expand New Jersey's income tax, raise the state sales tax, maintain our corporate business tax as a national outlier, and ignore the issues that drive high property tax rates would only worsen our business climate," NJBIA's Siekerka says.

NJBIA's analysis of audited state revenues, expenses and debt found in New Jersey Comprehensive Annual Financial Reports, noted that state revenues increased 23% from 2007-2017, while state expenses increased 45% and state debt spiked 382% during the same period.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.