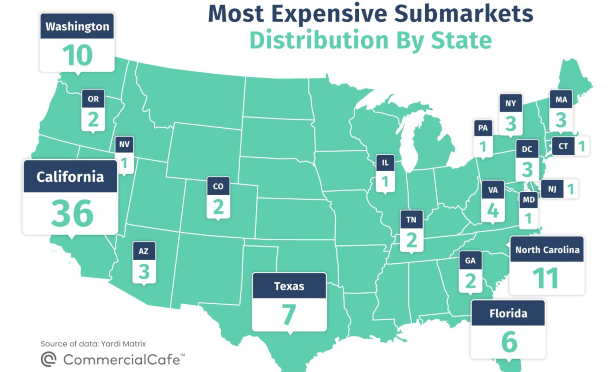

California cities are among the most expensive office markets in the country. A total of 36 cities in California landed on a list of the 100 most expensive office markets in the country from Yardi Commercial Café. California dominated the list overall, and Los Angeles and the Bay Area led with a total of 21 markets on the list. In Los Angeles, Santa Monica, Beverly Hills and, surprisingly, East Los Angeles, were on the list for most expensive markets. In San Francisco, the North and South Financial Districts both made the list along with SoMa.

California cities are among the most expensive office markets in the country. A total of 36 cities in California landed on a list of the 100 most expensive office markets in the country from Yardi Commercial Café. California dominated the list overall, and Los Angeles and the Bay Area led with a total of 21 markets on the list. In Los Angeles, Santa Monica, Beverly Hills and, surprisingly, East Los Angeles, were on the list for most expensive markets. In San Francisco, the North and South Financial Districts both made the list along with SoMa.

"It's no secret that the tech sector has a significant effect on office prices in California, particularly in the Bay Area. Large tech companies have been consistently active in Silicon Valley's office markets; Google was the buyer in all of the three office deals that pushed Mountain View-Shoreline to number one in the most expensive submarkets list," an expert at Yardi tells GlobeSt.com. "At the same time, the California office market also draws big bets from real estate investment companies: Beacon Capital Partners' $600 million purchase of the Zynga HQ was California's biggest office deal in 2019."

While some markets were nearly guaranteed to make the list, while others were surprising. In Los Angeles, East L.A. was in the latter category. "East Los Angeles made it to #19 thanks to its three office deals averaging $556 per square foot," says the Yardi expert. "The sale of the Ford Factory for $195 million was closed in January, but the other two deals were struck in October and December, respectively. For 2020, it's still early in the year, so any submarket that sees sustained interest in several high-value deals could crack the top 100."

The tech market is driving the pricing trends in these markets. "Pricing trends for the top California submarkets are largely decided by what tech giants and investment funds with large budgets set their eyes upon," says Yardi. "The most expensive submarket in 2018 was NYC's Chelsea, with an average price per square foot of $1,542 – in 2019, it rested at #9 with an average of $857 per square foot. California's most expensive submarket for 2019—Mountain View-West—did not make the 2019 list as it saw less than three deals that year. So, the general trend is that submarkets from California and New York City are consistently among the most expensive, swapping places according to where large deals take place."

The list, of course, is based on 2019 pricing trends, and it isn't necessarily a roadmap for pricing expectations in 2020. "It's early in the year to predict which submarkets will see price hikes in 2020, in part due to price volatility," says Yardi. "However, some submarkets did see considerable price growth between 2018 and 2019; on average, office space in Santa Monica went for $655 per square foot in 2018, but increased by 67% in 2019, at $1,097 per square foot. Similarly, prices in San Diego's University City went from $277 to $669, a considerable 141% increase. At a state level, California will continue to see consistent demand, but its top submarkets will fluctuate in ranking, depending on where significant sales take place."

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.