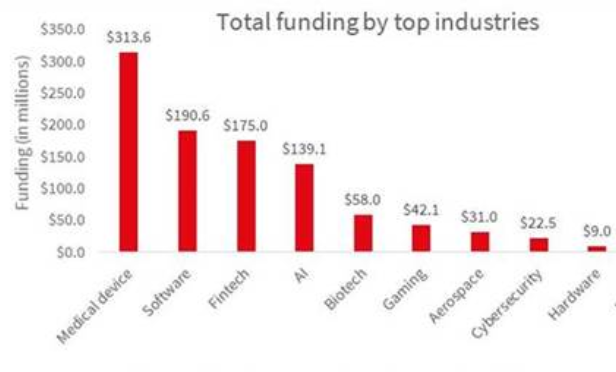

Tech and life science companies have raised nearly $1 billion in fundraising in 2019. Medical office device companies led the fundraising activity, with Axonics Modulation raising $127 million, Laboratory for Advanced Medicine raising $86 million, and Swift Health Systems raising $45 million. The activity is a sign that medical device companies are growing as a result of their location between San Diego and Los Angeles.

Tech and life science companies have raised nearly $1 billion in fundraising in 2019. Medical office device companies led the fundraising activity, with Axonics Modulation raising $127 million, Laboratory for Advanced Medicine raising $86 million, and Swift Health Systems raising $45 million. The activity is a sign that medical device companies are growing as a result of their location between San Diego and Los Angeles.

"The medical device market is experimental by nature, so fundraising is the oxygen to the lifeblood that is innovation, Scott Wetzel, EVP at JLL, tells GlobeSt.com. "Orange County has a long-standing history of innovation in the medical device sector and is home to companies like Edwards Life sciences, Abbot Laboratories, Glidewell, Johnson & Johnson and ICU Medical. Orange County's healthy medtech foundation has paved the way for a bright future."

The growth of these firms and this fundraising activity, which will inevitably fuel future growth, is translating into big wins for the real estate office market. "Medtech companies contributed to 500,000-plus square feet of new leasing in 2019. And this doesn't factor in the 25,000-plus employees who work in Orange County," says Wetzel. "We expect these numbers to follow the money. The US saw $130 billion in venture capital investments in 2019, surpassing $100 billion for the second year in a row. And medtech gobbles up a significant portion of this money."

Investors looking to get in on this activity should look at larger opportunities near existing companies. "Real estate investors should go big or go home," says Wetzel. "The majority of Orange County medtech companies are either incubator/early stage or very quickly moving towards maturity. Because the early-stage companies are dominated by M&A activity, more likely investment opportunities are "path of development" sites near existing medtech companies. We saw this when Edwards Life sciences acquired the former Royalty Carpet manufacturing site and MicroVention pre-leased—and later acquired—its Aliso Viejo headquarters."

The abundance of capital available in the private equity and venture capital markets will keep fueling growth in both tech and life science. "Despite recent volatility in the stock market, private equity and venture capital investors are sitting on historical amounts of capital," says Wetzel. "Leading innovators will continue to reap the benefit of the this stockpiled capital waiting to unload. If the past three years are any indication—2017 had a total of $472 million in fundraising; 2018 had $257 million; and 2019 had $314 million in fun raising—2020 will likely be another strong year for medtech investment and overall economic expansion, pending geopolitical stability."

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.