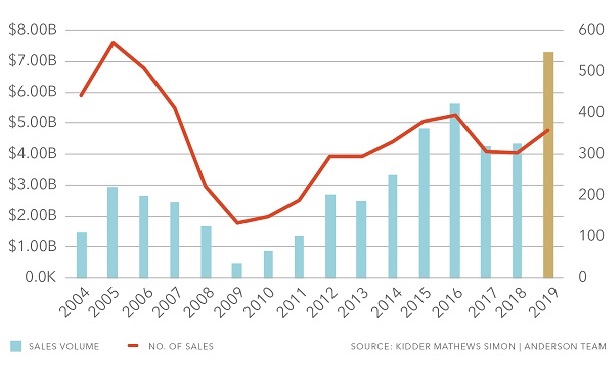

Puget Sound sales velocity shows a skyrocketing volume in 2019 for the local market.

Puget Sound sales velocity shows a skyrocketing volume in 2019 for the local market.

SEATTLE—A potent combination of investor confidence, continued job growth and the excise transfer tax increase led to a record-setting year of multifamily investment sales in the Puget Sound region, according to the 2020 market study released by Dylan Simon and Jerrid Anderson of Kidder Mathews. Seattle still shines in King County, but suburban markets are ramping up as the market cycle matures, and renter and investor demand shift out of the core.

"Entering the 127th month of this expansion cycle, we have solid economic fundamentals for persistent growth and stability in both the short term and the long term throughout the Puget Sound region," says Simon.

Seattle experienced a notable increase in institutional-sized apartment sales in 2019, particularly in the Downtown, First Hill and South Lake Union neighborhoods, which accounted for 46% of sales volume in urban King County. Across all neighborhoods, the average size of transactions was $22 million or double that of 2018.

Throughout King County, 2019 sales metrics demonstrated continued investor confidence with nearly 10% growth overall in price per unit. High demand met by limited opportunities to buy in East King County generated the highest year-over-year increases in both price per unit and price per square foot among the county's submarkets–13.3% and 20.4% respectively.

"Microsoft's strong presence, Amazon's plan to hire more than 15,000 people in Bellevue and the rapidly approaching opening of East Link Extension light rail stations mean that the Eastside is not just rivaling Seattle as the Puget Sound's top investment market but may soon surpass it," according to Simon.

Snohomish, Pierce and Kitsap counties all received attention from apartment investors in 2019, but each told a unique investment story.

In Snohomish County, there is a clear differentiation between northern and southern markets, which has been reflected in sales trends for the last 15 years.

"We do see investors going up to Arlington and Marysville now chasing yield, but from Everett north there have been fits and starts in pricing throughout this market cycle as rental rates can only grow so much," Simon explains. "However, the market dynamics of King County are directly pushing into South Snohomish, and metrics are more reflective of the urban core with clear trends of price per square foot increasing and cap rates compressing this market cycle."

In Pierce and Kitsap counties, the upward velocity of sales dynamics in each market validated investor demand. Pricing in excess of $200,000 per unit and $200 per net rentable square foot, previously reserved for King County and South Snohomish, became the norm.

The health of the Puget Sound office market signals long-term stability in the face of any future turbulence. Approximately 10 million square feet of office space is planned for the Seattle-Bellevue-Everett MSA, with slightly less than 7 million square feet under construction, 70 to 80% of which is pre-leased. As these offices are filled, more than 250,000 direct and indirect jobs will ultimately be added to the local economy, creating additional demand for apartments in the region.

"Seattle must continue to make room for new people to eat, shop, congregate and live," Simon tells GlobeSt.com. "Room in retail establishments, room in hotels, room in apartments. Much of this room is already underway, yet we are 10 years into the expansion segment of an economic cycle with concerns of a recession abound."

This market research covers 2019 sales of five-plus unit apartment buildings across the Puget Sound (King, Snohomish, Pierce and Kitsap counties) and Portland metro (Multnomah, Washington, Clackamas and Clark counties), as well as 20-plus unit buildings in the Willamette Valley (Salem and Eugene metros).

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.