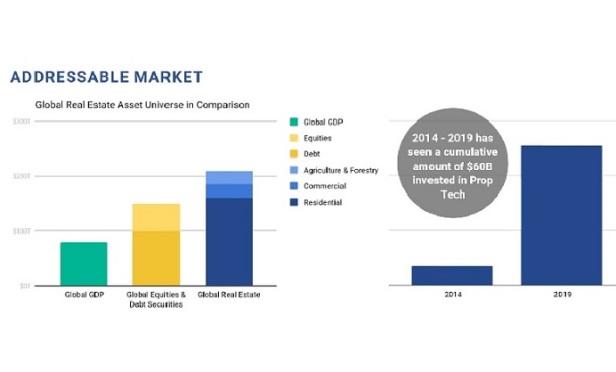

From 2014 to 2019, jumping last year, a cumulative amount of $60 billion has been invested in PropTech.

From 2014 to 2019, jumping last year, a cumulative amount of $60 billion has been invested in PropTech.

SAN FRANCISCO—Dealpath, real estate investment and portfolio management software provider, recently received a strategic investment from Blackstone. The investment contribution was not disclosed.

The partnership provides Dealpath with industry experience and expertise from Blackstone's real estate and innovations teams. Blackstone intends to continue building upon the Dealpath platform as a core of its data strategy and architecture for maximum value creation from pipeline to portfolio management.

"Dealpath is transforming an industry that has $1 trillion transacted annually with only makeshift means of deal management, either by cobbling together legacy tools such as Excel plus Word plus email or spending enormous resources attempting to customize CRM systems," said Mike Sroka, co-founder and CEO. "At Dealpath we believe that real estate is driven by people with information to shape our built world. We believe that intuitive, purpose-built software empowers collaboration, decisions and scale. Everything that Dealpath does is in pursuit of maximizing value of real estate investment and capital markets in the Internet age."

As of late, Dealpath clients are benefiting from immediate returns and results including 475% ROI, 20% more deals evaluated, 30% fewer errors in underwriting and due diligence, 50% increase in weekly productivity and 60% lift in employee satisfaction.

"Blackstone has been leveraging Dealpath as a client with rapidly expanding deployments that are generating significant value for our businesses. Dealpath has solved important needs for Blackstone and the industry with centralized data that is highly performant and globally accessible. This enables seamless collaboration across teams, partners and systems, and institutional grade data security. We view it as the foundation of a modern real estate tech stack and key player in the digital transformation of real estate," said John Fitzpatrick, managing director of Blackstone innovations and infrastructure.

Dealpath is now backed by venture capital and strategic investors that include Blackstone, JLL Spark, 8VC, GreenSoil Investments, Goldcrest Capital, LeFrak, Milstein and Bechtel. This new investment comes less than a year after the company closed a Series B round.

"This is a step up from the last round," Sroka tells GlobeSt.com. "Blackstone is Dealpath's largest key client and our work together started in 2016. We've stayed in close communication during the past two years and Dealpath deployed on many Blackstone entities during that time. We also expanded during that time, and through data sharing and collaboration, saw how Dealpath can be part of that universe."

Sroka points to how real estate has noticeably changed from the 1960s, when REITS were dominant, and into the 1980s and 1990s when private equity was a large part of the equation. Today, the majority of real estate is owned by professional management companies.

"This requires new tools to unlock value," he tells GlobeSt.com. "The economies of scale are changing in real estate. Companies are acquiring more portfolios. This requires structuring and automating data, and we feel we've crossed the chasm to adoption, which is really exciting. Clients know they must be involved to compete and they are seeing a real return on investments."

With offices in San Francisco and New York City, Dealpath has surpassed $5 trillion in transactions supported on the platform. Investment managers use Dealpath as a command center for pipeline tracking, deal analytics and workflows that result in investment decisions with operational leverage and lower enterprise risk.

"This investment partnership with Blackstone is the result of our shared views on the incredible opportunity of real estate being digitally transformed and we unlock the value of structured data and intelligent work," continues Sroka. "We see an inevitably bright future ahead with more programmatic portfolio management and transaction execution in the world's largest asset class and this critical part of our economy and way of life."

From 2014 to 2019, especially last year, a cumulative amount of $60 billion has been invested in PropTech, according to Dealpath. The global real estate market has topped $200 trillion.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.