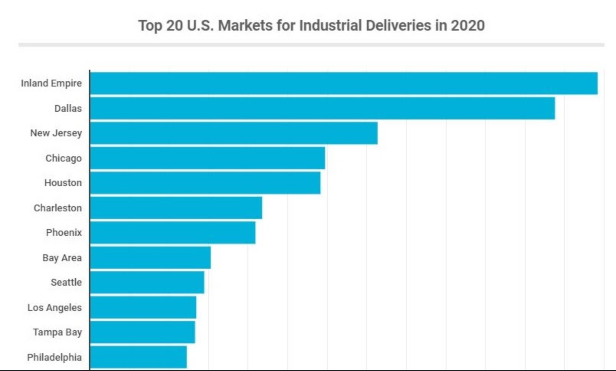

Los Angeles and the Inland Empire are two of the top markets for new industrial construction in the country. According to a new report from Yardi Commercial Café, 5.3 million square feet will deliver in Los Angeles this year, and in the Inland Empire—the most active industrial construction market in the country—has nearly 26 million square feet scheduled for deliver this year. In total between the two markets, a total of 121 buildings will come to market this year. In Los Angeles, this is an 86% increase in new construction deliveries compared to 2019, which had 2.9 million square feet delivered.

Los Angeles and the Inland Empire are two of the top markets for new industrial construction in the country. According to a new report from Yardi Commercial Café, 5.3 million square feet will deliver in Los Angeles this year, and in the Inland Empire—the most active industrial construction market in the country—has nearly 26 million square feet scheduled for deliver this year. In total between the two markets, a total of 121 buildings will come to market this year. In Los Angeles, this is an 86% increase in new construction deliveries compared to 2019, which had 2.9 million square feet delivered.

"As the economy was hitting new highs, Los Angeles simply continued on the trajectory from last year," Patrick McGregor of Yardi Commercial Café, tells GlobeSt.com. "[Los Angeles'] prime location amid a major port and airports, mixed with developable land, make the region extremely attractive. There's also been a supply shortage in the region that developers are trying to mitigate."

Phase IA and IB of the Center at Needham Ranch in Santa Clarita is one of the largest new industrial developments in the Los Angeles area totaling 870,000 square feet. However, the majority of new construction activity is smaller box facilities. "Warehouses far outpace more specialized industrial buildings simply because their more versatile," says McGregor. "While the large developments of 1 million square feet or more make headlines, the majority of industrials buildings under construction are between 50,000 and 400,000 square feet."

While industrial demand has been at record highs in Southern California, creating a severe undersupply of facilities, the recession created by the coronavirus outbreak could disrupt that activity and put some properties delivering this year at risk of staying vacant. "The economy is likely to take a hit, but it's hard to know exactly how this will affect projects already under construction," says McGregor.

Without the recession, the current construction activity would likely not be enough to meet current demand in the market. "If the demand exists, then developers will find a way to deliver," says McGregor. "I'm not sure that the supply coming online will meet the necessary demand this year, but it will definitely help. There are already projects scheduled for 2021 and beyond though too."

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.