US Department of the Treasury. Photo by Shutterstock.

US Department of the Treasury. Photo by Shutterstock.

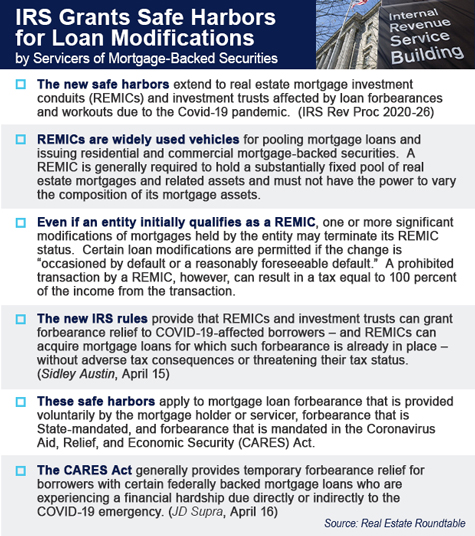

WASHINGTON, DC—Last week the Internal Revenue Service issued rules that provide safe harbor for loan modifications by mortgage-backed securities servicers.

The Real Estate Roundtable has explained what the new rules mean for the commercial real estate industry in an alert.

For starters, the new safe harbors extend to real estate mortgage investment conduits and investment trusts affected by loan forbearances and workouts due to the Covid-19 pandemic.

REMICs pool mortgage loans and issue residential and commercial mortgage-backed securities. If it varies the composition of its mortgage assets or makes significant modifications of mortgages, its REMIC status may be terminated. Certain loan modifications are permitted if the change is "occasioned by default or a reasonably foreseeable default." A prohibited transaction by a REMIC, however, can result in a tax equal to 100 percent of the income from the transaction.

What the new IRS rules do, according to the Sidley law firm, is allow REMICs and investment trusts to grant forbearance relief to COVID-19-affected borrowers. Also, REMICs can acquire mortgage loans for which such forbearance is already in place, without adverse tax consequences or threatening their tax status.

"A servicer can forbear on a non-federally backed mortgage loan already in a REMIC through the end of 2020 without (i) jeopardizing the status of the REMIC, (ii) jeopardizing the treatment of such mortgage loan as a "qualified mortgage" for tax purposes or (iii) causing the REMIC to be subject to a prohibited transaction tax provided that the servicer does not forbear for a period in excess of six months," Sidley explains.

These safe harbors apply to mortgage loan forbearance that is provided voluntarily by the mortgage holder or servicer, forbearance that is state-mandated, and forbearance that is mandated in the Coronavirus Aid, Relief, and Economic Security (CARES) Act, the Roundtable says.

For other voluntary forbearance programs not mandated by the CARES Act or state law, loan servicers are not legally obligated to enter into a payment forbearance and the servicing standard must be independently exercised to determine whether a particular payment forbearance is appropriate, according to a summary on the new rules by Alston & Bird.

"However, once a loan servicer determines that a payment forbearance is appropriate, if a servicer enables a forbearance that meets the revenue procedure's conditions, the REMIC or investment trust holding the mortgage loan or the REMIC subsequently acquiring the mortgage loan will obtain the benefits of the revenue procedure's safe harbors," the law firm wrote.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.