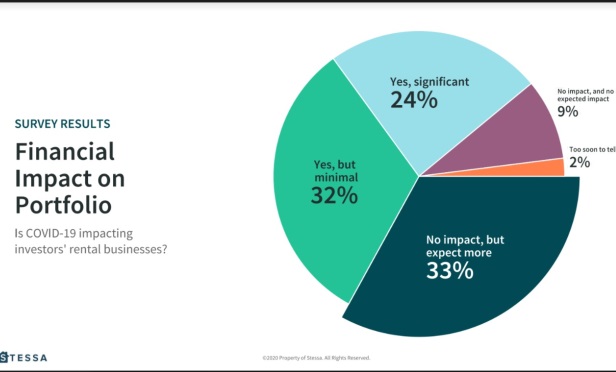

Stessa says 33% of respondents indicate COVID is not impacting rentals but that may change.

Stessa says 33% of respondents indicate COVID is not impacting rentals but that may change.

SAN FRANCISCO—The current economic and health crisis has affected many around the globe. One of the harder hit sectors is real estate, although investors remain bullish for its long-term potential, GlobeSt.com learns in this exclusive.

San Francisco-based proptech firm, Stessa, surveyed nearly 1,000 of its active real estate investors with rental properties in early April to get input on how the COVID-19 crisis has affected rental income and portfolio performance. The results were combined with financial data from the Stessa database of more than 50,000 users to draw conclusions about the present and future of residential real estate investment.

While the focus has been primarily on the larger multifamily operators, smaller landlords who hold about 50% of real estate investment assets have largely been a question mark. The data in this report represents property investors from all 50 states, 75% owning single-family rentals, 70% owning five rental properties or less, 50% owning multifamily rentals, 12% owning vacation rentals and 7% owning commercial rentals.

Data released by the National Multifamily Housing Council shows that 69% of apartment renters paid rent by April 5, compared to 82% as of April 5, 2019. The multifamily asset class is experiencing income disruption, but this doesn't account for smaller investors and those investing in single-family homes.

Real estate investors are definitely feeling some pain from non-payment or partial payment of April rents as job losses mount. Specifically, 57% of respondents cited rent default as an increasing issue.

However, most continue to harbor optimism that portfolios will hold up reasonably well during the next 12 months although it's clear that the COVID crisis will impact real estate cash flows for the short term. While investors agree that COVID-19 has impacted portfolios or will in the future (29% of investors predict portfolio values will decline by 10%), 44% plan to continue investing at the same pace and only 17% plan to pull back on new purchases or sell properties this year. Furthermore, 25% expect to grow portfolios more aggressively than originally planned, with 66% of surveyed real estate investors ranking real estate as their preferred long-term investment over other traditional asset classes such as stocks, bonds and cash investments.

"This shows optimism among real estate investors who are expecting to find opportunities in the crisis," Heath Silverman, Stessa CEO, tells GlobeSt.com. "Smaller landlords remain positive about the asset class long term, and believe the current environment will lead to the ability to expand portfolios in the next 12 months."

Stessa was founded in 2016 and acquired by Jones Lang LaSalle in 2018.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.