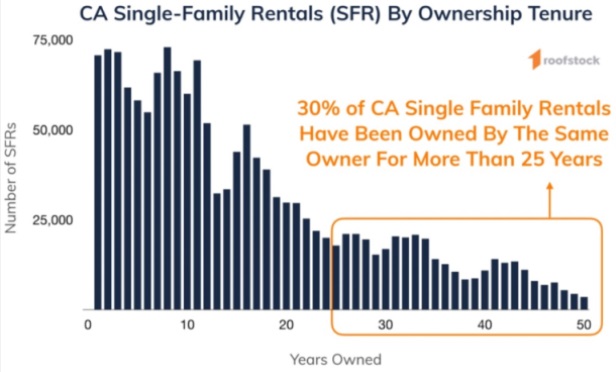

In California, 30% of single-family rentals have been owned by the same person for at least 25 years.

In California, 30% of single-family rentals have been owned by the same person for at least 25 years.

OAKLAND, CA—At $2.2 trillion, the Coronavirus Aid, Relief and Economic Security Act passed one month ago far surpasses any economic stimulus program in US history. While the government acted swiftly to pass the legislation, the real estate industry and consumers are slowing starting to understand how effectively it will be able to provide assistance to all who need it.

The stimulus package aids renters in unprecedented ways such as moratoriums on evictions even if rent is not paid. But there is a void about what this means for rental home owners. These owners depend on timely rent payments in order to cover expenses such as property taxes, mortgages, insurance, HOA fees, repair and maintenance costs, etc.

Contrary to popular belief, 95% of the nation's rental home stock is owned by individuals, not large institutions. In California, one in eight residents (nearly 1.7 million people) own rental properties and 30% of single-family rentals have been owned by the same person for at least 25 years, according to online marketplace, Roofstock. While it is possible this type of owner enjoys a lower tax basis or tax payments and perhaps doesn't have a mortgage, this may also be a retiree who depends on the rent as a primary source of income.

Census Bureau data reports the average American renter allocates roughly 30% of monthly income toward rent. In addition, the Joint Center for Housing Studies of Harvard University estimates that the percentage is even higher for lower income households, where 72% of renters in the lowest income segment allocated more than 50% of monthly income to rent. Already without much of a cushion under normal circumstances, if these tenants are among the 22.5 million people who have filed for unemployment in the last several weeks, this could quickly create a situation where paying the rent becomes a challenge.

What happens if a rental home owner does not receive rent and also has no cushion to fall back on? Many of these individual rental owners are essentially small business owners and this rent provides the income to meet the rental home's costs and expenses, such as taxes and insurance.

However, unlike a certified small business, there isn't a credit line or much spare cash to lean on when rents aren't paid, especially for continuous months. In a worst-case scenario when there is no rental income for a sustained period of time, the owner could lose the home. In the event of heightened unemployment for an extended period of time, it is unquestionable that the risk of widespread non-payment of rents would increase, says Roofstock.

Unfortunately, property owners have been stuck in the middle between lenders and tenants. This could impact renters, owners and communities heavily, even in the short term, having trickle-down consequences for the community and the availability of rental properties.

As the economic fallout of COVID-19 continues, Gary Beasley CEO and co-founder of Roofstock, proposes policy solutions to help mom and pop landlords and individual property owners stay afloat while still protecting the tenant. Roofstock proposes solutions including a voucher program similar to Section 8 that provides subsidized rent assistance.

"Rather than give a lump sum of money that can be used for anything, landlords would get a portion for housing expenses," Beasley tells GlobeSt.com. "In this process, landlords could register their properties in a database which would be tied to releasing funds for use during the COVID or any downturn. This fund would cover this obligation and its ripple effects."

For implementation to be quickly successful, the processing burden will likely need to fall on the rental owners and/or property managers, but technology could ease the way by quickly creating a self-serve approval process. Another benefit with this approach is that even if the renter is unable to make rental payments, merely knowing that some rental income would be coming could give the rental home owner confidence to continue with normal upkeep and ownership of the property.

"We just want to make sure that landlords are part of the conversation," Beasley tells GlobeSt.com.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.