As concerns over climate change intensify and regulations evolve, commercial real estate investors and owners are under increasing pressure to reduce carbon footprints of their properties, or "decarbonize" them. Most recently, California passed the Climate Accountability Package, which will require a large number public and private companies conducting business in the state to report on their GHG emissions and disclose climate-related financial risks. This comes just before the anticipated SEC rules for climate-related risks disclosures for all publicly traded companies. Aside from regulatory pressure, transitioning towards more sustainable practices mitigates financial and physical risks. But how should companies go about setting the right decarbonization goals and how could they achieve those targets?

One often used framework is the Carbon Risk Real Estate Monitor (CRREM) Pathway strategy, which helps companies assess their carbon and energy performance and determine when and how much they need to decarbonize in order to avoid stranded assets (properties at risk of economic obsolescence due to not meeting regulatory standards or market expectations).

Understanding the CRREM Pathway

Recommended For You

The goal of Carbon Risk Real Estate Monitor is to help companies "assess, manage, and avoid risk." The CRREM Pathway provides a toolset for investors and owners to evaluate the exposure of their real estate assets to carbon-related transition risks, and its primary objective is to offer a roadmap for decarbonizing properties in alignment with the global climate targets of the Paris Agreement.

In brief, the CRREM Pathway provides certain steps that companies will follow:

- Risk Assessment: Begin with a thorough assessment of properties to understand the carbon-related risks. The CRREM tool can help determine the current and future regulatory exposure based on location, type of property, and other variables.

- Set Targets: Based on the assessment, companies would set clear decarbonization targets for each property. CRREM provides decarbonization pathways for various asset types, helping owners align with international climate goals.

- Stakeholder Engagement: Companies collaborate with tenants, service providers, and other stakeholders. Stakeholder involvement is crucial in implementing sustainable measures and achieving decarbonization targets.

- Decarbonization Measures: Once targets are set, companies will decide on and implement the energy efficiency measures necessary in order to help the properties decarbonize.

- Monitoring and Reporting: Regularly monitor the carbon performance of the properties and compare the data to CRREM goals and forecasting.

The CRREM tool is currently not as robust in the US as it is in Europe – CRREM currently only has data for fifteen US cities – however, there are ways around the lack of data by using estimations to fill in gaps.

Decarbonization Proforma

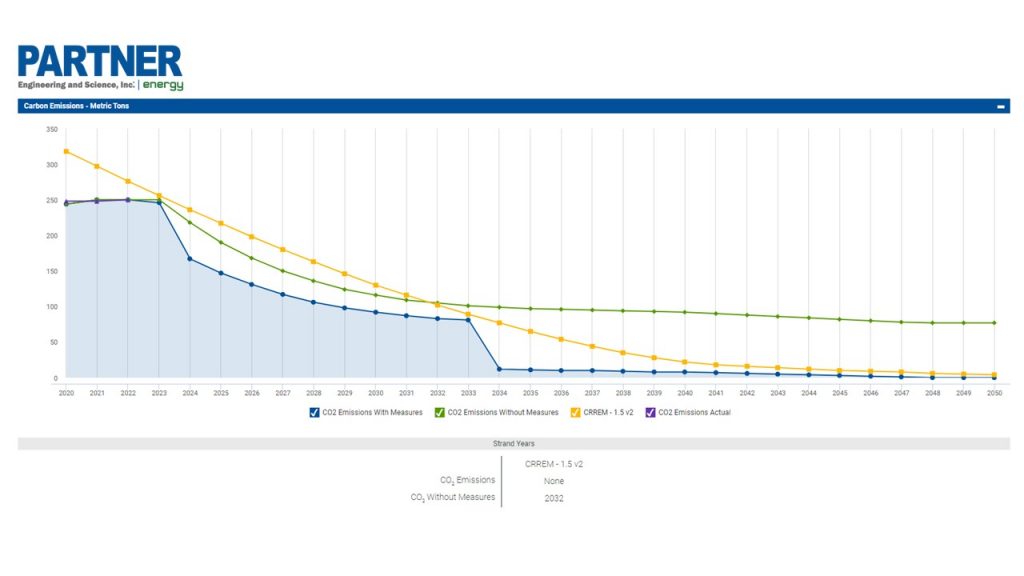

Once the client has committed to the CRREM Pathway or another net zero carbon pathway, it is time to plan which measures to implement in order to achieve the decarbonization goal. This is where technology can significantly ease the decision-making process. Partner Energy utilizes our Decarbonization Proforma tool, which takes inputs from the pathway to calculate the current carbon performance of the property and predict future performance based upon projected electric utility decarbonization modeling.

The proforma includes a list of energy conservation and electrification opportunities identified for the site. The client can choose the implementation year for making improvements to a property, and the proforma will calculate the effect on carbon emissions allowing the client to meet carbon emissions reduction goals for the property. This tool allows clients to capital plan, compare their assets to the CRREM Pathway, and monitor progress over time.

A Note on Stranded Assets

An emerging concern for commercial real estate investors and owners, particularly in the context of decarbonization and the CRREM pathway, is the issue of stranded assets. These are properties that are at risk of a write-down or devaluation. In the realm of sustainability and climate change, assets can become 'stranded' due to regulatory changes, technological advancements, or evolving market demands that render certain properties less valuable or entirely obsolete.

Implications for Commercial Real Estate

- Regulatory Pressure: As governments across the world enact stricter carbon emission regulations, properties that cannot meet these standards may face penalties or higher taxes, rendering them less profitable or even non-viable. An example of this is NYC's Local Law 97, which will require buildings over 25,000 square feet to achieve 40% reduction of emissions by 2030 and 80% by 2050. There are hefty penalties for non-compliance, including $268 for every excessive ton of emissions above the cap annually.

- Shift in Tenant Preferences: Tenants, both commercial and residential, are increasingly seeking energy-efficient and sustainable properties. Whether it is due to a company's own sustainability goals or personal tenant preferences, buildings that fail to cater to these demands may face higher vacancy rates. In certain cases, tenants may prefer a sustainable property due to regulatory pressures on them. For example, California's WAIRE Program requires operators of warehouses in the South Coast AQMD area to reduce their nitrogen oxide and diesel emissions or be subject to fees. In this case, a warehouse property with EV charging stations would be more preferable for the tenants occupying it.

- Transition Costs: Assets that are late to adapt might incur higher transition costs in the future. For instance, retrofitting an old building to meet new energy standards can be significantly more expensive than integrating these features during initial construction.

The urgency to decarbonize commercial real estate properties will likely increase given the pending laws and regulations, as well as heightened investor expectations. The CRREM pathway provides a systematic and efficient approach to this challenge, though it is not the only one available. By integrating decarbonization pathways with practical carbon reduction methods, CRE investors and owners can safeguard their assets for the future. For firms with a large portfolio, decarbonization of an entire portfolio can seem a daunting task, but this is where sustainability consulting firm and the right technology can help by guiding the client toward their goals. For more information about getting started with decarbonization, tune into Partner Energy's live webinar "Strategies and Tools for Achieving Decarbonization Goals".

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.