The primary reason New Boston Fund is selling the property, he adds, is that an "unfavorable" loan that transferred with the property, when it was acquired in 2004, had come up for prepayment. That, coupled with the emergence of new supply in the neighborhood and submarket, prompted New Boston to put it on the market. "It was the timing of the loan that really drove the property sales strategy," Bakalchuk says. "Otherwise we would have held onto it for longer, as it was doing very well for us. It was one of our better acquisitions."

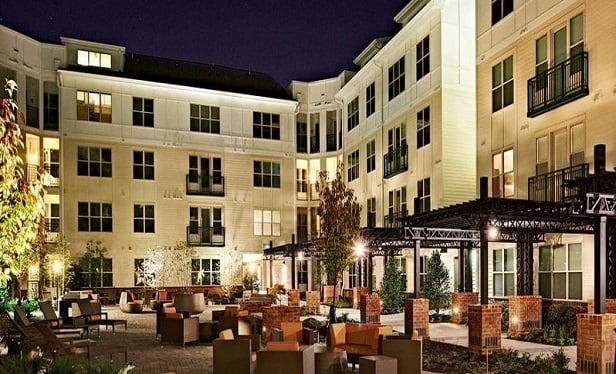

A class A, four-story single building with a six-story 454-car garage, Dulaney Crescent Apartments is home to mainly 'move-down buyers'-- that is, adults who have sold their homes to move back into low-maintenance apartments. This group could afford the increases in rent New Boston put in place after it acquired the building, Bakalchuk says.

"We had a demographic that was able to afford the rent increases without too much of a stretch so there was little turnover." Occupancy is currently 98%; throughout New Boston's ownership it never dropped below 95%, he says. When it took over, New Boston raised the rents to approximately $1,400 from roughly $1,250.

Built in 2003, Dulaney Crescent is located at 20 Lambourne Rd., eight miles north of Baltimore. The regional Towson Town Center Mall is across the street; Goucher College and Towson University are also very close. CB Richard Ellis' William Roohan and Michael Muldowney brokered the sale.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.