SAN FRANCISCO–Prologis is acquiring rival industrial REIT DCT Industrial Trust in a stock-for-stock deal for $8.4 billion. The deal, which boards of directors for both companies have approved, comes as e-commerce activity is driving industrial demand to new heights.

BTIG estimates that the deal represents “$67.91/sh” for DCT's stock, a 15.6% premium over market close on Friday, April 27. It also estimates the implied cap rate on the transaction at 4.3% to 4.5%, which is 40 to 60 basis points lower than its most recent NAV estimate. BTIG analysts write that while the rationale makes sense — portfolio overlap, last-mile/infill focus, strong development platform — “Prologis offered a sizeable premium (26.3x 2018 FFO/sh) in an already aggressively priced sector.”

Complementary Portfolios

Denver-based DCT Industrial Trust's 71 million square foot operating portfolio will expand Prologis' presence in Southern California, the San Francisco Bay Area, New York/New Jersey, Seattle and South Florida. Prologis chairman and chief executive officer Hamid R. Moghadam said the REITs' respective portfolios are very complementary and will allow Prologis “to capture significant scale economies immediately.”

In addition, he said, “our current platform initiatives, particularly in the areas of advanced analytics, customer experience and procurement and ancillary revenues, will enable us to extract significant upside from the combined portfolios.”

In a research note Mizuho REITs analyst Richard Anderson called DCT Industrial Trust a “standout” and a “clear growth leader since it revamped the company. The REIT now has 71 million square feet of operating assets weighted toward infill coastal areas. “In our view, the quality of the DCT portfolio and the improvements it has made over the past several years are being reflected in the terms of this transaction as they currently exist,” he wrote.

The acquisition will include:

- 7.1 million square feet of development, redevelopment and value-added projects

- 195 acres of land in pre-development, predominantly in Seattle, Atlanta, South Florida and Southern California with build-out potential of over 2.9 million square feet

- 215 acres of land under contract or option, mainly in New York/New Jersey, Southern California, Northern California and Chicago, with a build-out potential of over 3.3 million square feet

The transaction is expected to create near-term synergies of $80 million in corporate general and administrative cost savings, operating leverage, interest expense and lease adjustments, which are forecast to increase annual stabilized core funds from operations per share by $0.06-$0.08. A combination of revenue synergies and incremental development volume could generate $40 million of additional annual revenue and development profit in the future.

Under the terms of the agreement, DCT shareholders will receive 1.02 Prologis shares for each DCT share they own. The transaction, which is currently expected to close in the third quarter of 2018, is subject to the approval of DCT stockholders and other customary closing conditions. At closing, it is expected that DCT Industrial CEO Philip L. Hawkins will join the Prologis board of directors.

Unabated Demand For Industrial Product

The industrial sector has been operating at near capacity for years as e-commerce activity and last mile demand continue to fuel growth. As CBRE noted in its 2018 industrial and logistics report:

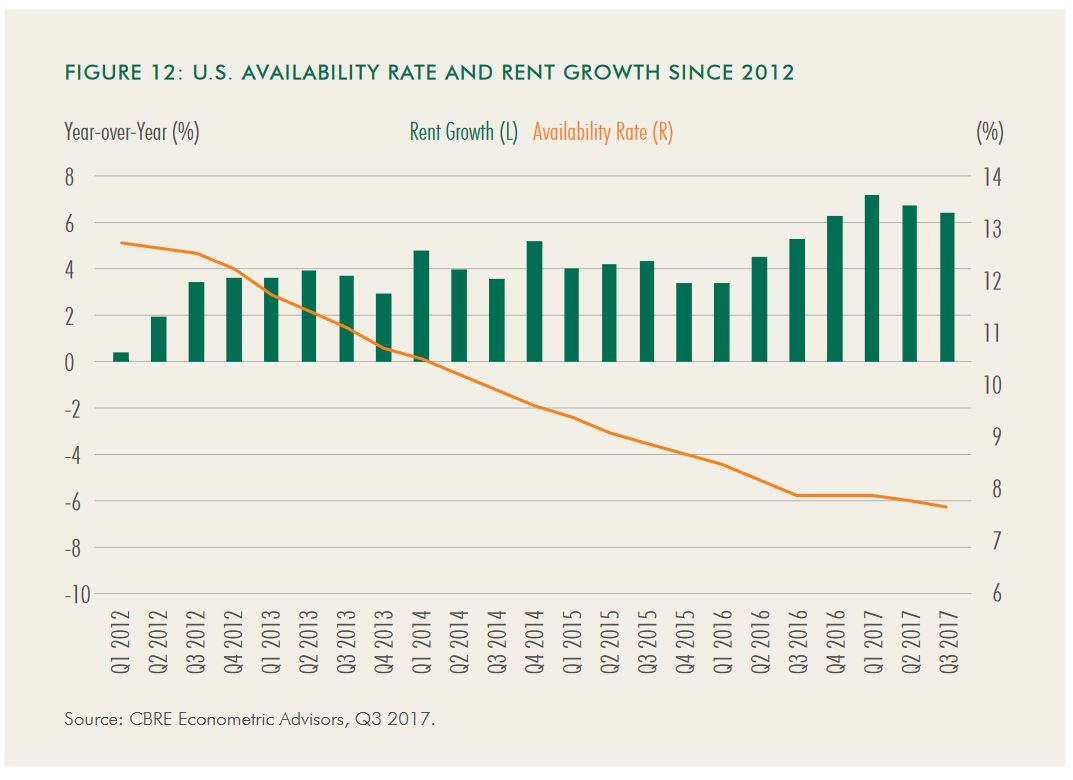

Consistent demand for all types of warehouse space, steadily declining availability and a steady rise in rents have been this cycle's hallmarks, resulting in some impressive milestones: 30 consecutive quarters of positive net absorption, availability at its lowest since 2001, and 24 consecutive quarters of rent growth.

It predicts that over the next year rents will continue rising at roughly the rate of the past few years. It also notes that although the gap between supply and demand narrowed in 2017 to near-equilibrium for the first time in more than a decade, the inability of the supply side to meet demand remains a problem. Last mile users are struggling to find adequate prime infill space, while development of warehouse space in infill locations is difficult due to the high costs of building in cities and the lack of large sites that can support warehouses.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.