Amazon just opened an Amazon Go store in downtown Chicago, its first in the metro area.

Amazon just opened an Amazon Go store in downtown Chicago, its first in the metro area.

CHICAGO—The challenges faced by brick-and-mortar retailers is well-known. And many people are also starting to realize that the overall outlook has a lot of positive aspects. In fact, even though e-commerce will continue to expand its share of consumer spending, the US retail marketplace should end the year on a strong note, and continue to expand at least to mid-2019, according to a recent report issued by Cushman & Wakefield.

Company researchers found that, due to sky high consumer confidence and continued wage growth acceleration, consumer expenditures show a steady 2.5-3% year-over-year growth pattern since the beginning of 2016. E-commerce sales accounted for approximately 11.5% of retail sales in 2017, but not withstanding the many retail bankruptcies, the impact on the sector as a whole has not been apocalyptic.

“While we expect that penetration rate to climb to 14.0% by 2019, physical stores remain vital to retailer survival in this evolving retail climate,” according to the report. “Despite what the media would lead you to believe, the overall retail industry is still posting gains even while it faces secular challenges.”

Significant bankruptcies have continued in 2018, but at a slower pace, C&W says. As of early October, the year-to-date total is 14, compared to 36 total filings in 2017.

And an exclusive focus on these events may obscure the positive developments. A recent report by IHL Group indicates store openings outnumber closures so far in 2018, with an estimated positive net gain of 3,835 stores nationally.

“Occupancy growth has continued for non-mall shopping centers overall, although the pace has notably cooled from the post-recession average,” C&W adds. Net absorption reached nearly 5.7 million square feet in the third quarter of 2018, bringing this year's total to 16.2 million square feet. This compares to 19.9 million square feet in the first three quarters of 2017 and 29.7 million square feet over the same period in 2016.

Not withstanding the e-commerce challenge, the retail sector has made steady progress in the last few years.

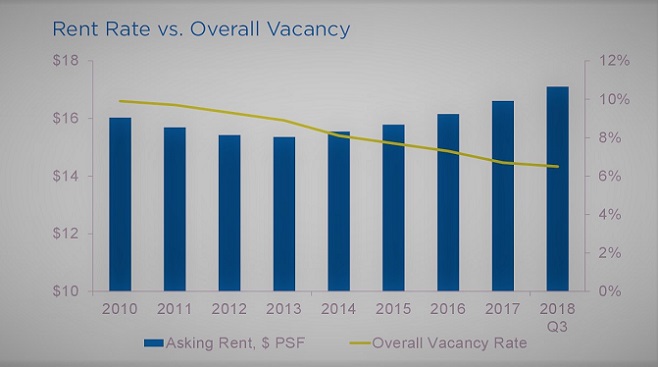

Not withstanding the e-commerce challenge, the retail sector has made steady progress in the last few years.The vacancy rate for non-mall shopping centers ended the third quarter of 2018 at 6.5%, unchanged from the previous quarter, but down from 6.7% at year-end 2017, the data show. The Pacific and Northeast regions both have vacancy rates under 6.0%, led by Boston and San Jose which boast the lowest rates in the nation at just 3.4% and 3.8%, respectively. Raleigh/Durham, Miami and Charleston follow closely, all with vacancy rates of 3.9%.

Neighborhood and community centers, many of which feature internet-resistant tenants such as restaurants and service-oriented businesses, are generally faring well. Net absorption for this sector totaled 11.8 million square feet for the first three quarters of 2018. And the vacancy rate for the sector declined to 7.1% in the third quarter of this year, down 10 bps from the previous quarter and down from 7.4% at year-end 2017.

Power centers took a big hit due to this year's closure of about 800 Toys R Us stores. This sector saw almost 1.1 million square feet of negative absorption since June, and that brought the vacancy rate back up to 5.0% in the third quarter of 2018, identical to the year-end 2017 figure. “However, year-to-date net absorption in the power center sector remains positive for 2018—at 586,589 square feet—and there are a handful of mid-to-big-box tenants in expansion mode, particularly among fitness/health, and entertainment and off-price categories.”

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.