Big box retail closures, which continued to strike through 2018, will create opportunities in the coming year. Toys R Us, among others, have shuttered this year, but rather than panic about the increased space, the market is instead embracing opportunities to transition those spaces into more consumer-friendly retail experiences, like movie theaters and restaurants, or into different, higher and better-use asset classes, like multifamily.

Big box retail closures, which continued to strike through 2018, will create opportunities in the coming year. Toys R Us, among others, have shuttered this year, but rather than panic about the increased space, the market is instead embracing opportunities to transition those spaces into more consumer-friendly retail experiences, like movie theaters and restaurants, or into different, higher and better-use asset classes, like multifamily.

"Big box closures are inevitable and they were no more numerous in 2018 than in past years. They had very little impact other than to create opportunities for retailers and developers," Gary A. Glick, a partner at Cox, Castle & Nicholson, tells GlobeSt.com. "Despite the closures, retail sales increased significantly in the last quarter of 2018 versus 2017. Big box vacancies are creating numerous opportunities for other retailers to pick up choice locations in vibrant shopping centers. This is true for the Toys 'R Us locations. With respect to department store closures, developers are presented with opportunities to re-purpose their centers with theatres, restaurants, medical or multi-family uses. With so little new retail construction, these spaces will be filled up or re-purposed quickly."

While big box vacancies are an opportunity for investors and developers, there are concerns that consumer spending could wan next year. "Many economists and retail experts have expressed concerns about a mild recession in the next few years," says Glick. "While we are seeing signs of extreme volatility in the stock market due to rising interest rates, the U.S. government's trade policies and the government shut down, consumer spending in 2018 was very strong and the hope is that any recession will be very soft and shallow."

In addition to waning consumer spending, rising interest rates are a concern of investors this year. "Mostly rising interest rates, although the ten year treasury rates have gone down the last quarter even though the Fed raised the federal funds rate four times in 2018" says Glick. "The existing trade wars and the volatility of the Trump administration are also creating concerns, and leading to rising prices for construction and retail goods. Sellers have yet to significantly adjust cap rates so the gap between buyers and sellers on price has created some added pressure on investments sales."

Still, investors remain optimistic about the retail market and retail investment in 2019. Glick expects that grocery-anchored shopping centers will continue to be the favored asset class, especially properties in class-A locations. Tight underwriting standards, however, could limit retail investment activity. "There will be ample capital available for retail deals in 2019," he says. "However, the big question is how much of it will be deployed. If rigorous underwriting standards continue, we may see the flow of capital slowing. For the right product type or for preferred sponsors, capital should remain plentiful. The cost of capital will also remain cheap."

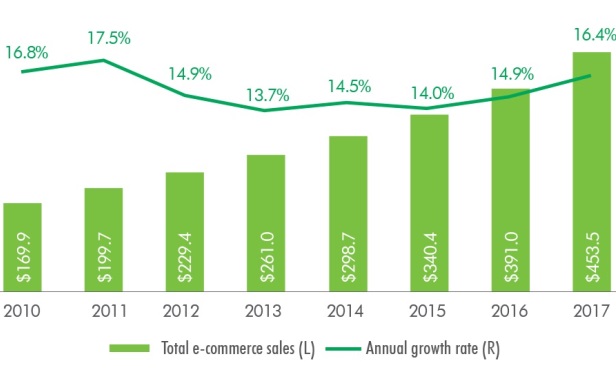

Moving forward, Glick also sees ecommerce as a benefit to retail, making it easier for people to shop and receive goods. "Amazon is enabling retailers and retail developers to become much better at what they do. Retailers now have an omni-channel approach and provide much better customer service," he says. "They also have started to use social media to their advantage. Retail developers have invested millions in their centers to bring in the right types of retailer/food users or complimentary uses, such as multi-family, entertainment or medical. The evolution of retail is creating great opportunities for those that are willing to change with the times."