Courtesy Marcus & Millichap

Courtesy Marcus & Millichap

CALABASAS, CA—Global financial market volatility, a number of weak foreign economies and lower alternative investment yields are once again underscoring what most of us already know: that foreign investors look upon the US as a stable choice for their capital.

Further, as Marcus & Millichap states in its Q3 Special Foreign Investment Report, the emphasis in that phrase is on safety: “Together, these forces have drawn additional foreign investment to the US, encouraging many to focus on capital preservation and asset stability rather than yield.”

Two trends are driving this foreign-capital momentum, which Marcus pinpoints in excess of $90 billion last year, or 17 percent of the total US investment volume—at least where the foreign player can be identified. One of those two trends is predictable: that the large gateway cities, with New York, L.A., Atlanta, Chicago and Dallas leading the way, dominate the foreign money focus. In fact, 43 percent of the global capital outlay last year was targeted to these five cities.

The other trend might be more of a surprise. Despite the headline-grabbing size of such deals as last year’s $1.95-billion acquisition of Manhattan’s Waldorf Astoria by Chinese investors, most “acquisitions tend to be smaller assets purchased through funds and domestic intermediaries,” says Marcus & Millichap.

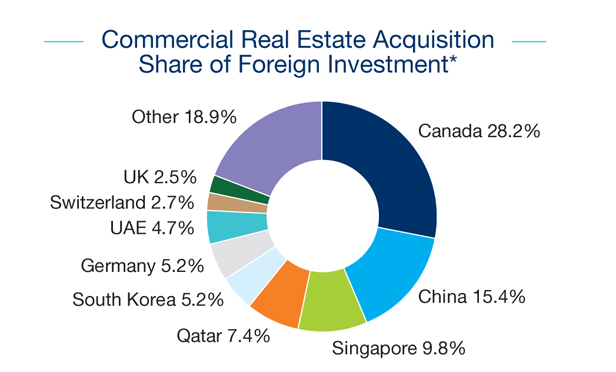

But who’s doing the buying? Canada by far outstrips other foreign players, garnering 28.2 percent of the total foreign investment pie (See chart). China takes the number two slot at 15.4 percent, and Singapore comes in at number three with 9.8 percent of the total. Rounding out the top five are Qatar (7.4 percent) and South Korea and Germany, tied at 5.2 percent. For the record, some 18.9 percent of the foreign acquisitions in the States were by “other” countries.

Marcus also points out that while English-speaking nations (Canada and Australia, for instance) find the cultural affinity an expedient to investments here, increasingly sophisticated constructs elsewhere are giving rise to greater participation. Such is the case in China, says the report, where a “rising population of high-net-worth individuals and households has launched a financial advisory and wealth management industry that could facilitate greater participation in US commercial real estate.”

While restrictions exist, such as a $50,000 annual cap on outgoing capital in China, “a number of methods have been employed to circumvent this restriction, including pooling capital from multiple investors, although this strategy has been used less frequently recently.”

Those are the prime buyers, but what are they buying to ensure their all-important capital preservation? On a total dollar volume basis, which emphasizes large trophy properties, office and hotel buys topped their lists so far this year. However, “from a transactional perspective, apartments and industrial properties were the leaders, representing a combined 57 percent of direct purchases by cross-border capital,” according to the report.

For the complete report, please click here.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.