James Postell, partner, city leader in Transwestern’s New Jersey office, left, and Matthew Dolly, Transwestern’s New Jersey research director

James Postell, partner, city leader in Transwestern’s New Jersey office, left, and Matthew Dolly, Transwestern’s New Jersey research director

PARSIPPANY, NJ—With at least 10 leases exceeding 100,000 square feet signed during the third quarter, New Jersey’s office market experienced its strongest summer in 13 years, according to Transwestern’s Third-Quarter 2016 Office Market Report.

The robust leasing activity was led by global pharmaceutical company Allergan’s 431,493-square-foot lease at 5 Giralda Farms in Madison, and software company iCIMS’s 350,000-square-foot lease at Bell Works in Holmdel. These notable transactions contributed to a drop in vacancy from 15.9 to 15.5 percent, the lowest level since second-quarter 2010.

Allergan, which received $58 million in state incentives after considering a move to neighboring Pennsylvania, will keep more than 1,000 jobs in the state, and plans to add 300 more. Meanwhile, iCIMS became the anchor tenant at Bell Works, which has been transformed from the largest abandoned office building in the United States into what owner Somerset Development calls a “Metroburb” — an urban core in a great suburban location.

“There is definitely renewed interest from pharma companies, and that is reflected in the fact that many large pharma companies decided to remain in the state and/or expand their footprint during the quarter,” James Postell, partner, city leader in Transwestern’s New Jersey office, tells GlobeSt.com exclusively. “For example, Allergan leased 431,493 square feet in Madison, receiving $58 million in state incentives after considering a move to neighboring Pennsylvania. The pharma giant will keep more than 1,000 jobs in the state and promised to add 300 more. Also, global pharmaceutical firm Mallinckrodt leased 233,000 square feet in Bedminster and Prinston Pharmaceutical, an emerging global pharmaceutical company, acquired 700 Atrium Drive, a previously vacant, 183,925-square-foot office building in Somerset. In addition, construction was recently completed on Celgene’s new 550,000-square-foot building in Summit — a commitment the biopharmaceutical company made when it acquired the former Merck campus slightly more than a year ago. Prior to this most recent quarter, other pharmaceutical giants recently signed major leases in New Jersey including Daiichi Sankyo, GlaxoSmithKline, Novo Nordisk, Valeant Pharmaceuticals and Bayer, to name a few. While the life sciences sector in New Jersey has not fully recovered the jobs lost during the recession, it’s extremely encouraging that many of the top pharma firms are demonstrating their commitment to New Jersey.”

Postell says the Grow NJ tax incentives play a critical role in attracting and retaining office tenants.

“Tax incentives are significant business drivers and a necessity for staying competitive, particularly in the State of New Jersey, where the cost of doing business is higher than in other states,” he says. “Several companies from various industries have relocated operations to this side of the Hudson Waterfront, and more are considering a move, and incentives are a key factor in their decision. Grow NJ has proven to be a powerful program for job creation, and has also attracted several technology companies to suburban areas, most notably iCIMS.”

Still, according to the Transwestern report, the New Jersey market continues to resemble “a game of musical chairs.” For example, Sharp Electronics is relocating to Montvale while Jaguar Land Rover North America will move into Sharp’s former offices in Mahwah, expanding from its own smaller Mahwah location. In addition, iCIMS, AIG, Valeant Pharmaceuticals International, Computershare Limited and Ikanos Communications all put space back on the market during the third quarter, resulting in an increase in vacant sublease space by more than 800,000 square feet to its highest level in four years.

Asking rents in the Hudson Waterfront submarket have reached $40 per square foot for class A space, and as high as $50 per square foot in some cases — similar to rents across the river in Downtown Manhattan.

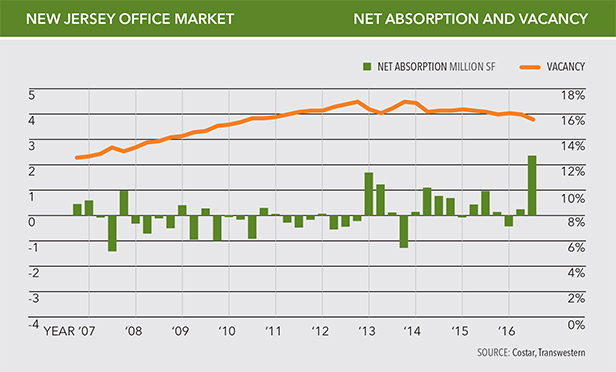

Third Quarter 2016 Net Absorption and Vacancy, from Transwestern Research

Third Quarter 2016 Net Absorption and Vacancy, from Transwestern Research

“We expect the strong leasing activity that we saw throughout the summer to continue into the fall and beyond, contingent upon a couple factors,” said Transwestern’s New Jersey research director Matthew Dolly. “Clearly, the reaction to November’s presidential election is a significant variable, and our team has been analyzing how the outcome of the election could impact demand for office space.”

Postell says creating a “lifestyle” for tenants in suburban office parks can help redevelop these less-attractive “stranded” assets.

“Developers who have had the most success reviving stranded office assets have understood that they not only have to invest in the asset and fill it with amenities, but they have to create a ‘lifestyle’ for the tenants and their employees,” he says. “More and more, work and home life are blended together, so employees want to be at a place where they enjoy their experience. Today, tenants are seeking a vibrant community, not just a place to work. For example, take 300 Kimball Drive in Parsippany — a property we transformed into a first-class, multi-tenant office facility. We’ve hosted a number of events that have benefited both tenants and the community at large, including holiday and coffee socials, food drives and various retail fairs. Bell Works is another outstanding example of ‘live-work-play,’ which is truly the way of the future for office redevelopment.”

Towns are increasingly recognizing that zoning modifications are needed to enable redevelopment efforts.

“With project approval in New Jersey proving to be too costly for many developers, we expect to see more towns modify or expand zoning regulations to accommodate the changing times and to allow for higher ratables,” says Dolly.

Transwestern

Transwestern

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.