McAllister: “When lease rates and sale prices vary by more than 10 cents (or $10 per square foot), companies in Orange County start looking east at Corona as an economical alternative.”

McAllister: “When lease rates and sale prices vary by more than 10 cents (or $10 per square foot), companies in Orange County start looking east at Corona as an economical alternative.”

ORANGE, CA—Industrial demand in Corona, CA, from various industries has pushed gross activity and rents up and vacancy down, and there has been an uptick in rollover from adjacent regions such as Orange County, where the market is even tighter, CBRE first VP Tom McAllister tells GlobeSt.com.

McAllister, who is based in the firm’s Orange County office, has seen a lot of activity in Corona recently in spite of a historic low inventory of buildings for lease, and he says that dock-high-loaded buildings are in demand.

We spoke with McAllister about the Corona industrial market and why industrial tenants are clamoring for space there.

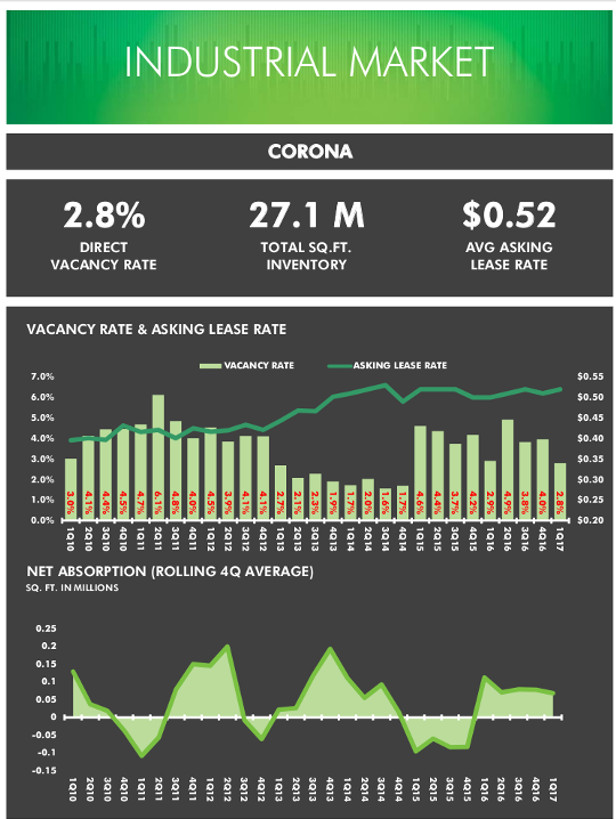

This snapshot shows how tight the Corona industrial leasing market is and the rise in asking lease rates since 2010. ***chart courtesy of CBRE Research

This snapshot shows how tight the Corona industrial leasing market is and the rise in asking lease rates since 2010. ***chart courtesy of CBRE Research

GlobeSt.com: How would you characterize the Corona industrial market?

McAllister: Corona is a mid-size industrial market comprising mostly warehouse (59.9%) and manufacturing (32.8%), with R&D (7.3%) accounting for a small fraction. The region is dominated by light-industrial assets with buildings below 100,000 square feet, accounting for 91% of the property count and 62% of the square footage in the market. In addition, Corona is ideally located in the western part of Riverside County in proximity to northeastern Orange County.

GlobeSt.com: What has been causing the increase in activity in this market recently in spite of a historic low inventory of buildings for lease?

McAllister: Since 2013, demand from the manufacturing, consumer goods (durable and non-durable) and construction sectors has pushed gross activity and rents up and vacancy down. In addition, there has been an uptick in rollover from adjacent regions such as Orange County (where the market is even tighter). Many of these tenants were willing to move because they can pay lower rent in Corona and still service their core markets in Orange County.

GlobeSt.com: What are tenants seeking in this market?

McAllister: Dock-high loading and fenced yards. All seven of the buildings I just leased had multiple dock-high doors, and five of the seven had fenced yards, as required by the tenants.

GlobeSt.com: What else should our readers know about Corona?

McAllister: Historically, 50% of Corona tenants come from within Corona and 50% come from Orange County. When lease rates and sale prices vary by more than 10 cents (or $10 per square foot), companies in Orange County start looking east at Corona as an economical alternative. Of the seven leases I just completed, one relocated from OC to Corona, three renewed or expanded existing Corona leases, one relocated from Ontario to Corona (unusual) and one relocated from Fontana to Buena Park (to better serve its OC customers).

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.